39+ can you still deduct mortgage interest

Web Mortgage interest and property taxes you paid while your friend was alive or after your friend died but the house was still in his name are not deductible by you. Web For 2021 tax returns the government has raised the standard deduction to.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

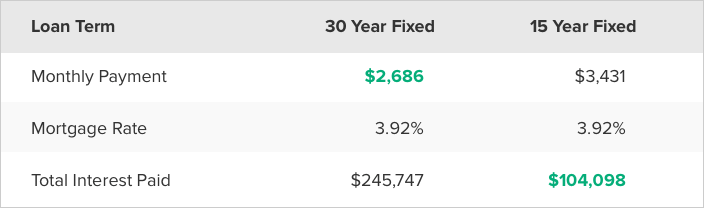

The terms of the loan are the same as for other 20-year loans offered in your area.

. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. You paid 4800 in. Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence.

Single or married filing separately 12550. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

For married taxpayers filing a separate. Web Taxpayers who took out a mortgage after Dec. Web Basic income information including amounts of your income.

18000 for heads of household. Web For tax years 2018 to 2025 the standard deduction has been increased to 12000 for singles and married filing separately. The previous limit was 1.

15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately. 18000 for heads of household. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web For tax years 2018 to 2025 the standard deduction has been increased to 12000 for singles and married filing separately. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web The debt cant exceed 750000 or 1000000 if the loan was taken before December 16 2017 to get the full deduction. Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Married filing jointly or qualifying widow er.

Web The deduction can be claimed only for the interest paid on mortgage debt up to 750000 if the loan was taken out after Dec. You or someone on your tax return must have signed or. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years.

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

Mortgage Interest Deduction Bankrate

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Mortgage Calculator Pmi Interest Taxes And Insurance

Fixed Variable Rate Uk Mortgage Repayment Calculator

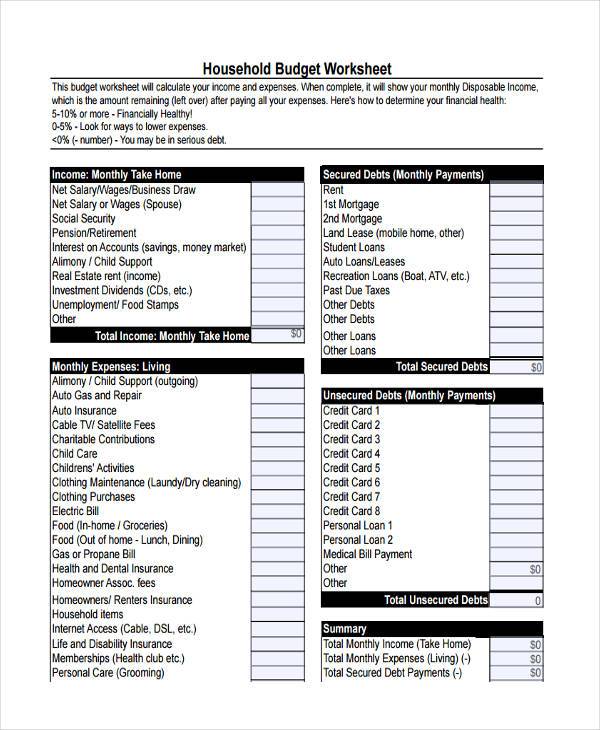

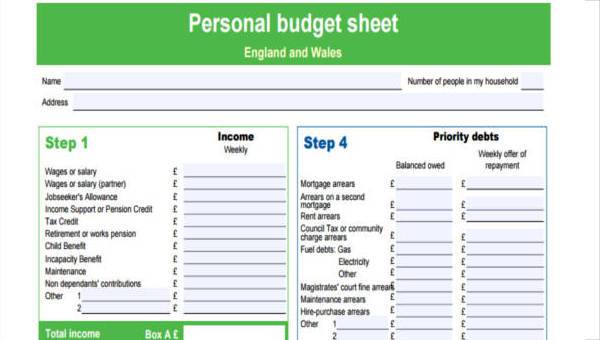

Free 39 Sample Budget Forms In Pdf Excel Ms Word

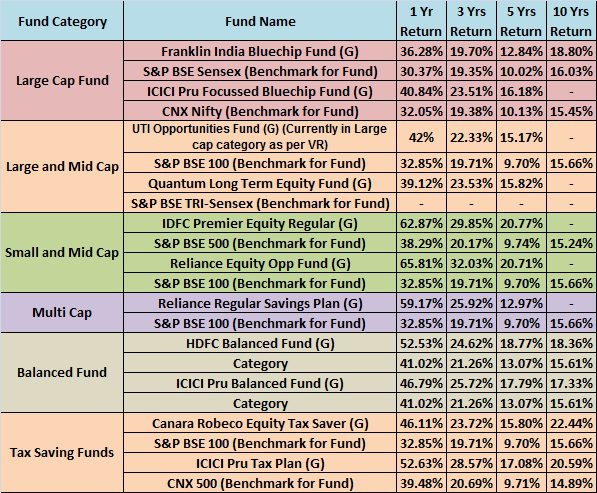

Top 10 Best Mutual Funds To Invest In India For 2015

Mortgage Interest Tax Relief Changes Explained Taxscouts

How To Create An Amortization Schedule In An Access Database Quora

Analyzing Interest Rates When Is 2 99 More Than 5 Truth Concepts

Belenus Augenzentrum Siegen Bitcoin News

Rural Change And Royal Finances In Spain D0e13063

Free 39 Sample Budget Forms In Pdf Excel Ms Word

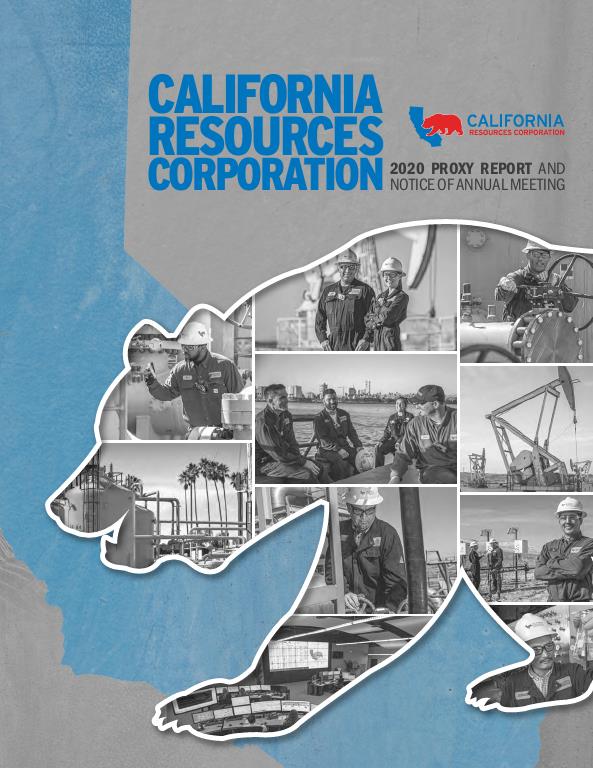

Crc Def14a 20200506 Htm