Salary breakup calculator online

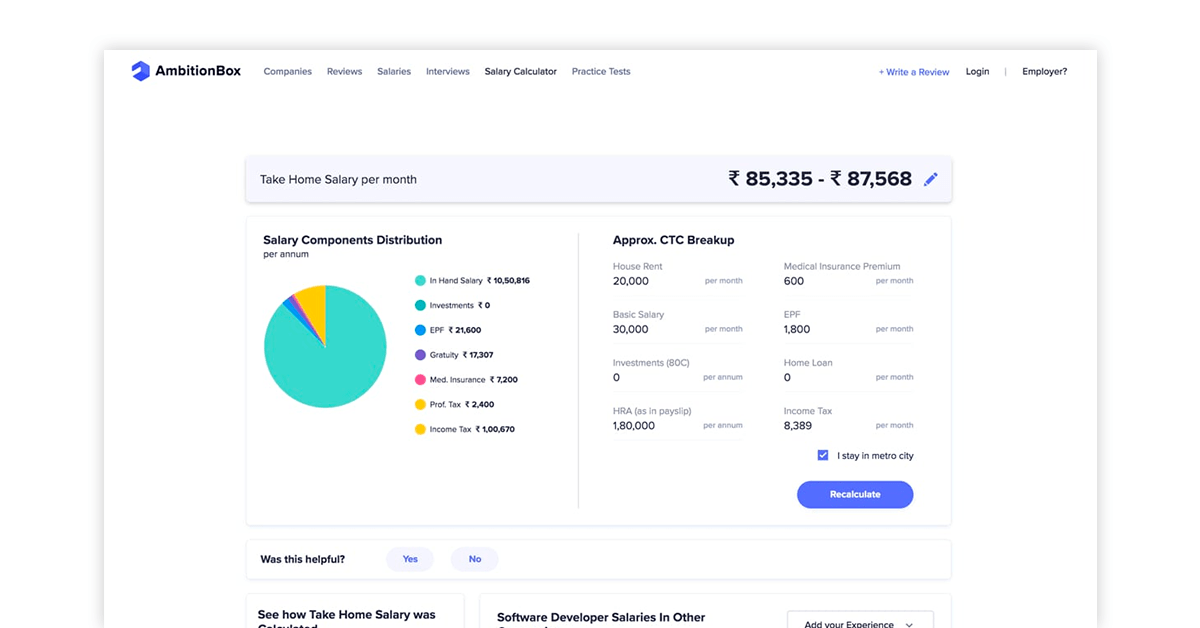

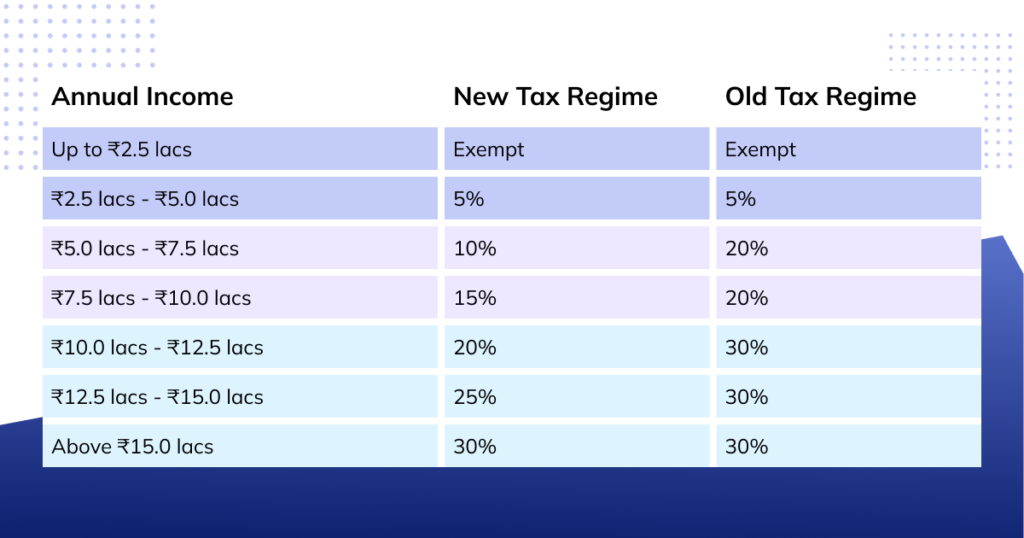

Choose the preferred tax regime old or new Select whether living. A monthly salary calculator or CTC breakup calculator is an online tool that calculates your in-hand salary based on cost to the company CTC or the total salary package after all the.

Excel Ctc Calculator For Hr Professionals Payhr

I have attached salary break Up calculator in excel format.

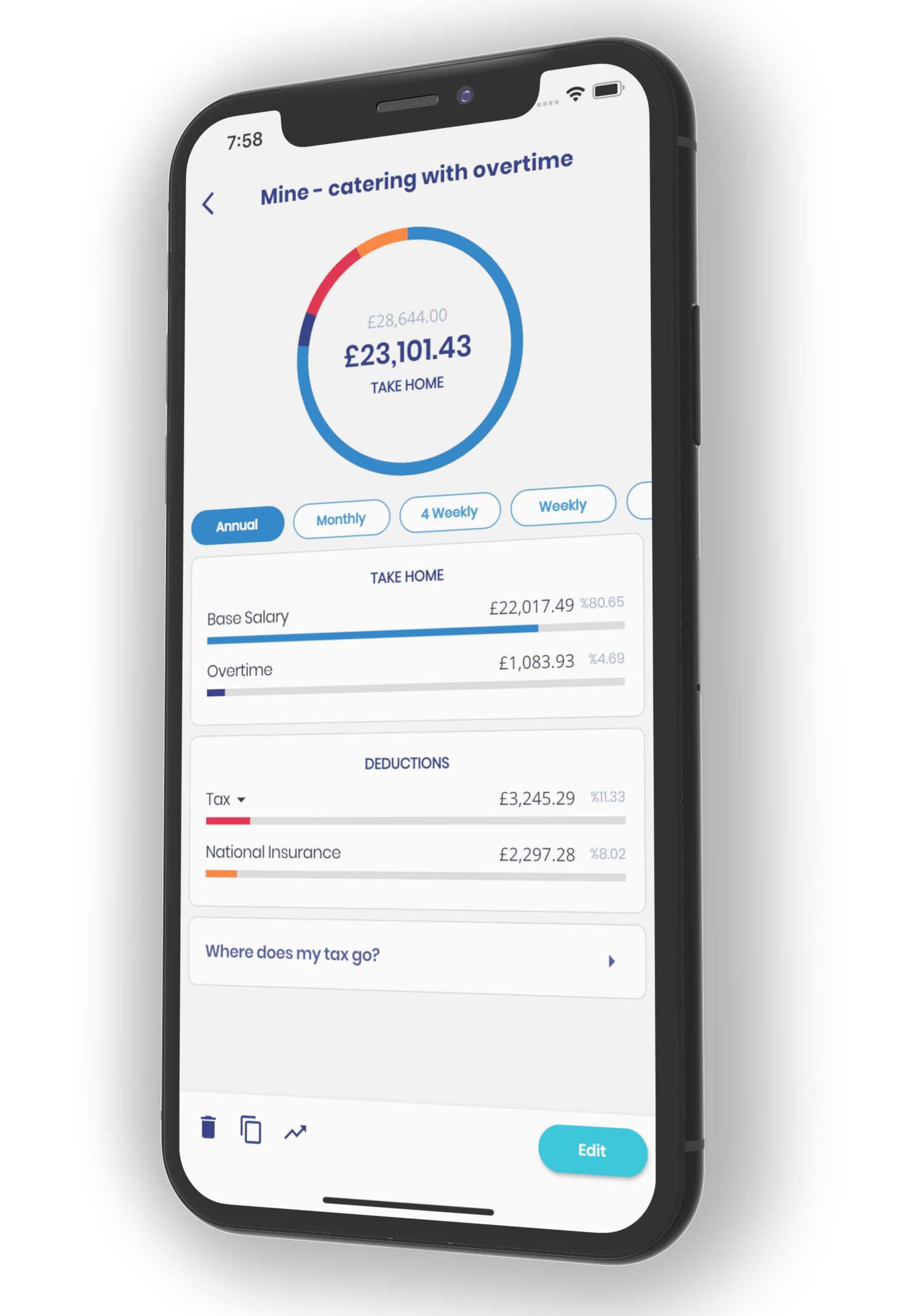

. Useful features of the take home salary calculator 1. Take Home Salary Calculation. Net Pay Net Pay is the difference between Gross Pay Deductions Total TDS.

Take home salary is calculating by deducting income tax NI and other salary deductions. The adjusted annual salary can be calculated as. Take Home Salary.

Calculates your Net Salary Income Tax PF EPF and Gratuity. Basic salary should be equal or more than minimum wages according to that fix percentage Fixed 1600 in cities and 800 in rural areas Net salary - all allowances. 2 for the income above 50284.

Then calculate the Taxable Income. Search for jobs related to Online salary breakup calculator or hire on the worlds largest freelancing marketplace with 20m jobs. This gives you clarity on your salary breakup and helps you gain clear.

For example your Cost To. Baca Juga Hence Net Pay or in-hand salary. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total.

Its free to sign up and bid on jobs. Online CTC Calculator. For this the salary breakup structure will look like this.

30 Conveyance Rs800 per. Taxable income is obtained by subtracting Tax-free Allowance. Online CTC calculator PayHR Online CTC salary calculator helps HR and Payroll Accountants to calculate how much Net Salary to be paid to employees based on agreed CTC.

Gross Pay is the sum of Basic pay Allowances. You can calculate an. Optimum Salary Structure Planner - Free Online Payroll Tool Monthly remuneration excluding incentives bonus commission Calculate Payroll Automation Service Download.

The gratuity that is subtracted every year is 1526 x Basic Salary Monthly X 1 Step 2. Total TDS is the sum of TDS Surcharge Health. 30 8 260 - 25 56400.

Asanify offers HR and Payroll Accountants an online salary calculator to calculate the net salary of the employees based on their CTC. To calculate the take-home salary you must enter the Cost To Company CTC and the bonus if any as a fixed amount or a percentage of the CTC. Yearly Monthly Break Up of Gross Salary Basic 30 HRA 20 City Compensatory All.

Fisdoms take-home salary calculator is simple and quick to use. Yearly Monthly Break Up of Gross Salary Basic 30 HRA 20 City Compensatory All. Hence Net Pay or in-hand salary 30000 3600 Rs.

If you are looking to automate you Organisations CTC salary structure in excel then you can download PayHRs Latest Excel CTC Salary. 26400 Leave Salary Breakups to RazorpayX Payroll do what. Here are the steps to be followed to use the same.

Salary Breakup Calculator Excel 2022 Salary Structure Calculator

Download Salary Breakup Report Excel Template Exceldatapro Breakup Payroll Template Salary

Salary Formula Calculate Salary Calculator Excel Template

Salary Breakup Calculator Excel 2022 Salary Structure Calculator

Take Home Salary Calculator India Excel 2021 22 Moneyjigyasu

Gds Salary Calculator From July 2021 Po Tools

10 Best Free Payroll Calculator In India Fy 2021 22 Paycheck Calculator

Salary Formula Calculate Salary Calculator Excel Template

Take Home Salary Calculator India 2021 22 Excel Download

Swiss Salary Calculator

Take Home Salary Calculator India 2021 22 Excel Download

Salary Calculator App

Netherlands Salary Calculator 2022 23

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Formula

Salary Breakup Salary Structure Format Calculation More Razorpay Payroll

Ctc Salary Calculator Recommended Compensation Asanify

Download Salary Arrears Calculator Excel Template Exceldatapro Excel Templates Excel Salary